Our Blog

Welcome to our Health Blog—your trusted source for clear, reliable health insights. From managing conditions to building healthier habits, we share expert-backed guidance to support your well-being.

Fixed Deposit: Which Bank Has the Best FD Rates for October 2024? + Quick Guide to Fixed Deposits (FD & FD-i)

Fixed Deposits (FD) and Fixed Deposit-i are widely trusted investment options in Malaysia, offering a secure way for people to grow their savings.

These choices have become popular because they are safe, reliable, and provide consistent earnings.

Let’s look at these options and understand their differences, along with the current FD rates in October 2024.

Your Guide to Fixed Deposits + Latest FD Rates

What is Fixed Deposit (FD) and Fixed Deposit-i (FD-i)?

What is Fixed Deposit (FD)?

Fixed deposits, commonly known as FDs, are traditional savings accounts offered by banks and financial institutions.

They function on a straightforward principle: you deposit a specific sum of money for a predetermined period, ranging from a few months to several years.

During this tenure, the deposited amount accrues interest at a fixed rate, which is typically higher than in regular savings accounts.

The interest rate remains constant throughout the agreed-upon period, providing investors with stability and predictability in their earnings.

What is Fixed Deposit-i (FD-i)?

Fixed Deposit-i, often referred to as Islamic Fixed Deposits, follows the principles of Islamic finance. These deposits are Shariah-compliant, adhering to Islamic laws that prohibit earning interest (Riba).

Instead of earning interest, investors in Fixed Deposit-i accounts enter into a Mudarabah or Wakalah contract with the bank.

Under Mudarabah, the bank pools funds from investors and engages in Shariah-compliant activities.

Profits generated from these activities are shared between the bank and the investors based on agreed-upon ratios.

Key Differences between FD and FD-i

FDFD-iInterest vs. profit-sharingEarn a fixed interest rate on your depositUsing a profit-sharing modelShariah ComplianceOperate on interest, which might not align with Shariah principlesShariah-compliantFlexibility in TenuresA variety of tenures, accommodating both short-term and long-term investment preferencesProvides diverse tenure options, allowing you to align your investment with your specific goals and needsInvestment Profit AllocationEarnings are based on fixed interest ratesOperates on profit-sharing; returns fluctuate based on profits from Shariah-compliant activities

Latest Fixed Deposit/FD rates for September 2024

1. Alliance Bank

Offer: Alliance Bank Fixed Deposit: Personal Welcome Offer

Interest Rates: 3.80% per annum for 6 months

Minimum Deposit: RM10,000

Promotion Period: 1 October 2024 – 31 March 2025

Offer details and conditions: Exclusively for Alliance Bank new account holders; must be deposited in 30 days.

Source: Alliance

2. CIMB Bank

Offer: CIMB eFixed Deposit-i (eFD-i)

Interest Rates:

Interest rate (%)Lock-in period3.453 months3.606 months

Minimum deposit: RM1,000

Promotion Period: 1 October 2024 – 31 October 2024

Preferential Terms: Users must use CIMB Clicks Website or CIMB OCTO APP, and transfer money from other banks to CIMB Bank accounts by FPX.

Source: CIMB

3. RHB Bank

Offer: RHB Term Deposit & e‑Term Deposit

Interest Rates: 3.70% per annum for 6 months *for all RHB Customer

Eligible CustomersTenureRateMinimum DepositAll RHB Customers6 months3.70%RM 5,000RHB Premier Customers6 months3.80%RM 20,000

Promotion Period: 23 August 2024 – 31 October 2024

Preferential Terms: Users must use HLB Connect Online or HLB Connect APP, and transfer money from other banks to Hong Leong Bank accounts by FPX.

Source: RHB Bank

4. BSN

Offer: BSN Term Deposit-i with BSN SSP Platinum

Interest rate:

BSN Term Deposit-iBSN SSP PlatinumPlacement ratioLock-in period5.50% per annum0.01% per annum70%:30%6 months

Minimum deposit: RM5,000

Offer period: 1 October 2024 – 30 October 2024

Offer Details & Conditions: Minimum placement amount is only for ‘New Funds”. Open to new and existing Bank Simpanan Nasional (BSN) customers.

Source: BSN

5. Maybank

Offer: Maybank e-Islamic Fixed Deposit-i (eIFD-i)

Interest Rates: 3.70% per annum for 6 months

Minimum Deposit: RM1,000

Promotion Period: 28 August 2024 – 31 October 2024

Offer details and conditions: Users must make eFD placement via the Maybank2U website.

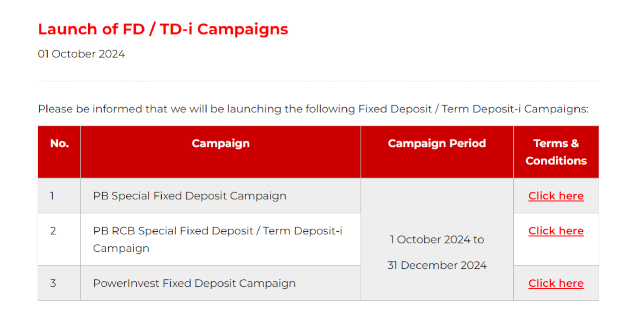

6. Public Bank

Offer: PB RCB Special Fixed Deposit / Term Deposit-i

Interest rates:

Lock-in periodFixed deposit rate3 months3.50%6 months3.70%9 months3.55%12 months3.60%

Minimum deposit: RM 5,000

Promotion period: 1 October – 31 October 2024

Source: Public Bank

Finding the best FD rates in Malaysia involves careful consideration. As a potential investor, focus on the duration, minimum deposit, and any special terms each bank offers.

By understanding these details, you can make a smart investment choice tailored to your needs. Stay informed, compare options, and choose wisely to maximize your earnings!

Looking for smart investment options? Interested in growing your wealth? Invest wisely in your future with a career with us – sign up here!

Frequently Asked Questions

Find quick answers to common questions about our services, pricing, and booking process.

How much do you charge for a pedicure?

Our pedicure services start at affordable rates, depending on the type of treatment and add-ons you choose.

What types of treatments do you offer?

We provide a wide range of treatments, including facials, manicures, pedicures, hair care, skin therapy, and wellness packages.

How do I book my appointment?

You can easily book online through our website, call our front desk, or visit us directly to schedule your preferred time.

Can I cancel my appointment?

Yes, appointments can be cancelled or rescheduled. We request advance notice so we can assist you and accommodate others.

Address

103, JALAN TTJS 3/6 , TAMAN TUANKU JAAFAR Negeri Sembilan 71450

Call Us

Send us a Mail

Opening Hours

Mon-Fri: 8:00 AM - 7:00 PM

Fri: 9:00 AM - 2:00 PM

Get in Touch with us

We’re here to help anytime

Call Us

Mail Us

Opening Time

Mon -Sat: 7:00 - 17:00

Providing trusted medical and health care services with compassionate care and advanced treatment. Your health is always in safe hands with us.

© Copyright 2025 YourBrand Name. All Rights Reserved.